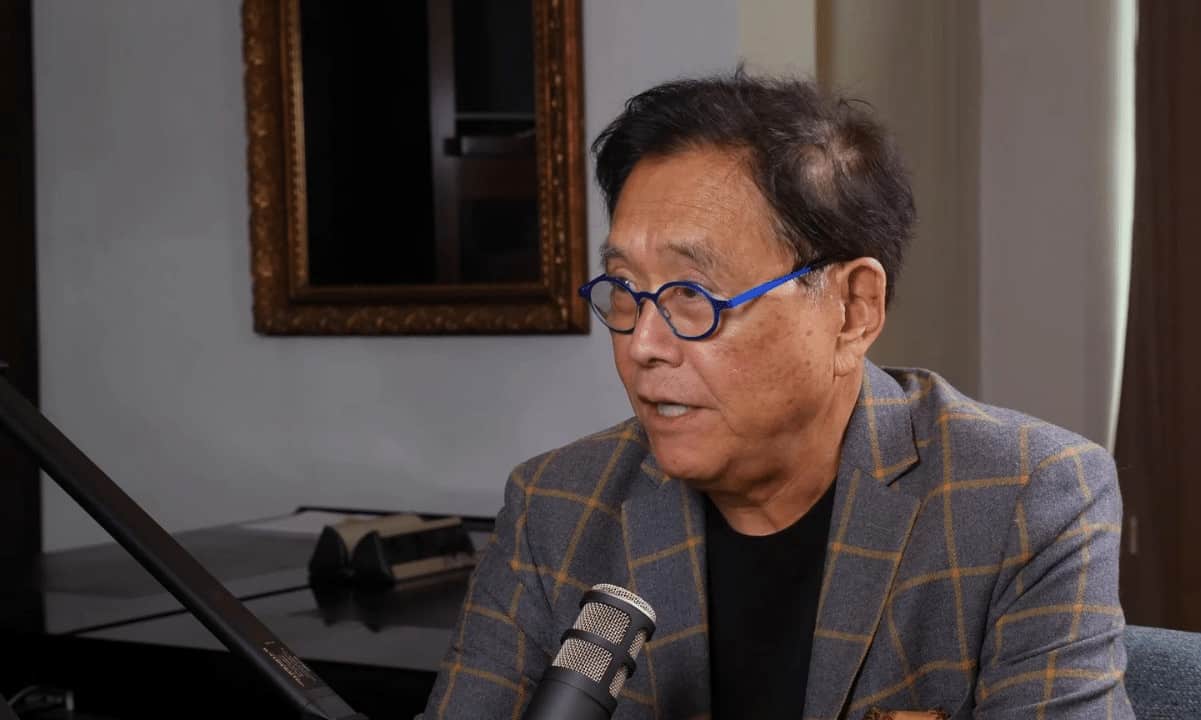

In an Apr. 20 post on X, Kiyosaki wrote, “BITCOIN is $84k today. Strongly believe Bitcoin will reach $180k to $200k in 2025.” Five days later, BTC was trading above $93,600.

BITCOIN is $84k today. Strongly believe Bitcoin will reach $180k to $200k in 2025.

What do you think?

— Robert Kiyosaki (@theRealKiyosaki) April 20, 2025

Earlier, on Apr. 18, the “Rich Dad, Poor Dad” author predicted that Bitcoin’s price will eventually skyrocket to $1 million. His related price predictions spelled doom for the dollar’s buying power:

“I strongly believe, by 2035, that one Bitcoin will be over $ 1 million dollars. Gold will be $30k and silver $3,000 a coin.”

“People who heeded my warnings are doing well today. I am concerned for those who did not,” wrote Kiyosaki in the long-form X update. He warned, “This coming Great Depression will cause millions to be poor… and a few who take action may enjoy great wealth and freedom.”

Dire Economic Straits and Enterprising Bitcoin Investors

Kiyosaki isn’t a contrarian voice to warn of a difficult economic downturn ahead. Federal Reserve Chair Jerome Powell warned in April that the US could soon be mired in a stagflationary period of low growth and rising prices.

Kiyosaki is also not the only financial expert who has predicted that Bitcoin’s price will reach $1 million.

In fact, his timeframe for it is conservative compared to Twitter founder Jack Dorsey’s, who predicted a $1 million BTC price by 2030 in May last year.

But, Kiyosaki is firmly in the high-conviction column for Bitcoin’s potential upside prices five and ten years from now. Here’s how some of his classic investment advice applies to BTC.

1. Kiyosaki on Income vs. Wealth

“The rich focus on their asset columns while everyone else focuses on their income statements.”

In his New York Times bestseller on personal finances and building wealth, Kiyosaki makes an important distinction between wealth and income. He points out that income takes most of your time and effort to sustain, but that wealth sustains your income automatically.

This means even high-income individuals can struggle under equally big spending routines and borrow money at substantial interest rates to maintain a certain way of living.

Thus, not long ago, PYMNTS and the Lending Club found in a survey that about 50% of Americans with six-figure incomes may be living paycheck to paycheck.

In April, the Philadelphia Federal Reserve said that late credit card payments and minimum payments are at the highest level since 2012.

Individuals and households with these spending routines are swimming in the opposite direction of the macro financial currents of the past ten years, as the voracious Bitcoin hoarders.

Managing finances this way is bargaining a harder tomorrow for an easier today. But the way frugal and thrifty saver/investors budget is bargaining a harder today for an easier tomorrow.

2. ‘Rich Dad, Poor Dad’ on Investing

“You must know the difference between an asset and a liability and buy assets. An asset puts money in your pocket. A liability takes money out of your pocket.”

Kiyosaki also discerns between assets and liabilities in an individual or household’s financial balance book. In his opinion, houses should not be considered assets because they cost money to maintain and finance.

During the US housing market boom that preceded the 2008 financial crisis and the great recession, conventional financial wisdom said to buy a house because its value would continue going up forever.

But starting in 2007, a mass wave of defaults and foreclosures crashed house prices. Bitcoin launched soon after that to create a space in the financial ecosystem based on settlement instead of lending.

Instead of paying future obligations to consume more today, as with housing loans, Bitcoin is like collecting future rewards by consuming more efficiently today and buying BTC with the savings.

If it continues to appreciate in value due to its scarcity and global popular demand, it will remain an asset rather than a liability like a mortgage, credit card balance, or college loan.

3. Bitcoin and Financial Literacy

“Illiteracy, both in words and numbers, is the foundation of financial struggle.”

Another key point of Kiyosaki’s message in “Rich Dad, Poor Dad” was that families, schools, and the government have mostly failed to educate Americans about the basics of finance and investing.

He says that many people don’t really understand the disadvantages of borrowing money and paying interest instead of saving money and collecting returns on investments.

That kind of bad financial math doesn’t just keep many Americans out of investing in Bitcoin and cryptocurrencies. It keeps them from saving any money using any method.

Last December, a Schroders US retirement survey found that half of Gen Xers, Americans aged 44 to 59, have not done any retirement planning at all.

In the cryptocurrency social media community, users like to post, “Do your own research.” Bitcoin aficionados especially like to post, “Do the math.”

One benefit of learning about investing and doing financial math is that it can help to counteract the often more convincing pull of immediate gratification and result in healthier financial behavior.

4. Household Finance, Consumer Debt, and Bitcoin

“A person can be highly educated, professionally successful, and financially illiterate. Many financial problems are caused by trying to keep up with the Joneses.”

In fact, the main thrust of Kiyosaki’s book is that he found it remarkable in the course of his life’s experiences, how blatantly neglected financial and investment thinking is among even people of high intelligence, career success, and social status.

The basics of accounting, budgeting, investing, and tax law are not learned or practiced by a shocking swath of the populace, he contends, despite the importance of these modalities to beneficial outcomes that people desire.

If most people cannot be bothered to devote two to three hours a week to learning and eventually mastering these reliably rewarding and basic areas of competency, then it’s no mystery why Bitcoin remains inaccessible to many because it sits well enough beyond their threshold for healthy curiosity.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!