Bitcoin is struggling to break through the crucial resistance at the 200-day moving average. A successful reclaim of this level could pave the way for a rally toward the $90K region.

Technical Analysis

By Shayan

The Daily Chart

BTC has rebounded from the ascending wedge’s lower boundary, aligning with the 0.618 Fibonacci retracement level at $78K. However, it now faces a significant resistance zone near the 200-day moving average ($85K), a level historically associated with strong supply and selling pressure.

A breakout above this key resistance could trigger a short-squeeze, potentially propelling Bitcoin toward the $90K mark. However, the presence of strong sellers at this level suggests that further consolidation is the more likely short-term outcome. If Bitcoin faces rejection, a retest of the ascending wedge’s lower boundary ($78K) could be imminent.

The 4-Hour Chart

On the lower timeframe, BTC has approached the upper boundary of a descending wedge at $85K. This pattern often signals waning bearish momentum and a potential bullish reversal.

A successful breakout above $85K could lead to a rally toward $90K. However, given current market conditions and a lack of strong buying demand, Bitcoin is more likely to continue consolidating within the wedge in the short term before making a decisive move.

Sentiment Analysis

By Shayan

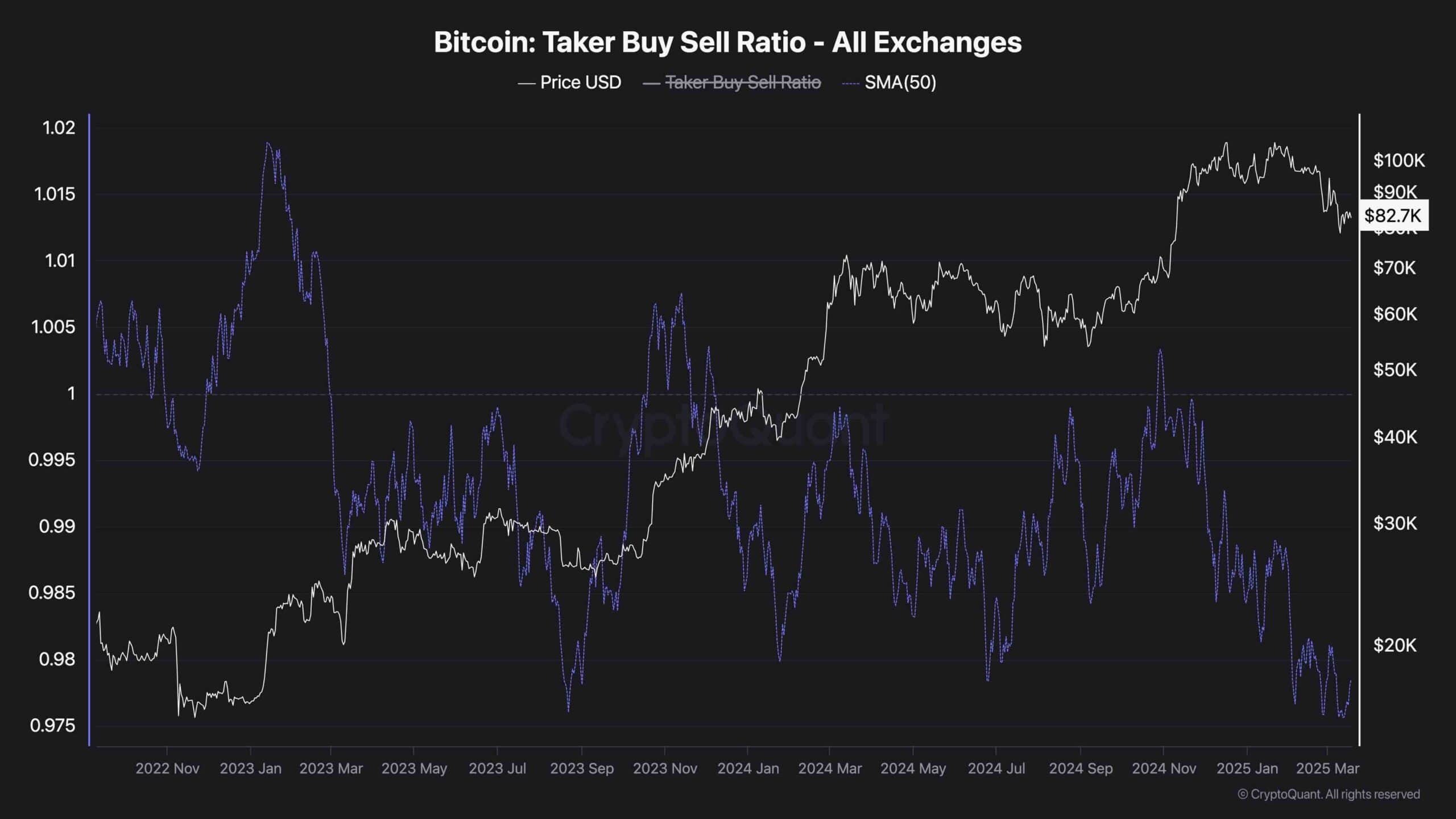

Bitcoin’s price remains stuck in a range, leaving investors questioning what is preventing the market from continuing its upward trend. A closer look at futures market metrics provides a potential explanation.

One key indicator, the Bitcoin taker buy-sell ratio, measures whether buyers or sellers are executing positions more aggressively in the futures market. Aggressive orders refer to those placed at the market price, indicating a higher urgency to buy or sell.

Recently, the 50-day moving average of this metric has been trending downward after months of steady increases. This shift suggests that sellers have regained control over the futures market, applying significant pressure and likely causing Bitcoin’s recent lack of bullish momentum.

If this trend continues, Bitcoin could struggle to break out of its current consolidation phase. However, if buyers regain dominance, a reversal in this metric could signal renewed bullish momentum and a potential breakout to higher levels.

The post Bitcoin Price Analysis: Will $80K Hold, or Is Another Breakdown Ahead? appeared first on CryptoPotato.