Crypto.com has ignited community outrage by re-minting 70 billion Cronos tokens as ZachXBT slammed the move and questioned Truth Media’s decision to partner with the exchange, a partnership that is now driving CRO’s 30% surge.

In his recent post on X, on-chain sleuth ZachXBT slammed Crypto.com for reissuing 70 billion Cronos (CRO) tokens—previously burned in 2021—restoring the total supply of CRO back to its original amount of 100 billion tokens. The decision to reissue the tokens was determined by a governance vote, where 77.97% of participants voted against it, while only 11.86% supported it. However, since that 11.86% controlled 70-80% of the total voting power, the proposal passed.

The reissued tokens have been placed in the Cronos Strategic Reserve with the aim of driving CRO adoption. The tokens will be subjected to a new lockup period of 5 years, adding to the previous 5-year lockup that has already elapsed since CRO was first issued on Ethereum (ETH). This means the total time the tokens will be locked is now 10 years. The reissued tokens will be gradually released via a native Cosmos SDK vesting account mechanism on the Cronos POS chain.

Despite the lockup period and the vesting schedule, the reissuance of the burned CRO caused significant community backlash since these tokens were supposed to be burned “forever.”

ZachZBT condemned the move, stating, “CRO is no different from a scam.” He also questioned why Truth would partner with the exchange over Coinbase, Kraken, Gemini or others.

“My first thoughts: massive dilution. Selfishness from the company as nobody from the community would benefit from it,” one anonymous large CRO holder told Unchained.

“A burn is a burn, burnt tokens shouldn’t be brought back to life. I’m almost never against anything happening on Cronos, but today, I’m against it, big time!,” wrote Crypto.com ambassador Wyll Bilderberg.

“We want a lean, efficient tokenomics model that prioritizes burns to drive value, not a bloated supply dressed up as ‘strategy.” said LEGION, a Cronos builder.

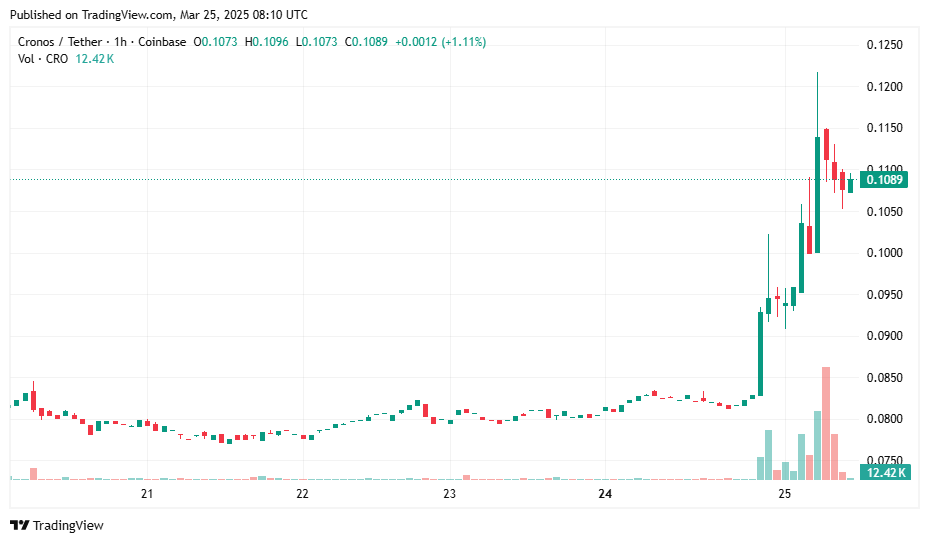

Despite community backlash, CRO has surged 30% over the past week following token re-issuance. In the past 24 hours alone, CRO has jumped 28%, with trading volume soaring 1,357% to over $295 million. The rally appears to be driven by Crypto.com’s partnership with Truth Media Group, as the announcement hinted at a potential Cronos ETF.

The partnership, announced on March 24, fuelled an immediate rally in CRO, which broke out of its consolidation range of around $0.07 – $0.08 and surged to $0.12 by March 25. However it has since retraced down to $0.10 at press time.

The sharp surge in CRO’s price despite community backlash suggests that speculative interest is currently driving the market. However, while short-term traders may be capitalizing on the rally, the long-term implications of reissuing 70 billion CRO are uncertain.

As sentiment swings between optimism and skepticism, CRO’s future trajectory will likely depend on whether Crypto.com can actually leverage its expanded treasury to drive real adoption—or if the re-minting decision will just dilute supply and ultimately exert downward pressure on CRO price.